Australia’s lithium-ion mobile power station market (1kWh-10kWh) is growing rapidly due to increasing demand for portable power in outdoor activities, emergency backup, and renewable energy applications. Key players such as EcoFlow, Bluetti, and Jackery offer products priced between AUD 1,200 and AUD 6,500, depending on capacity and features like solar charging and fast charging. Domestic transportation costs range from AUD 50 to 300, while international imports incur additional customs and shipping fees. The market has significant growth potential driven by technological advancements and shifting consumer habits, though high prices and low-quality alternatives present challenges.

Market Overview

- Demand Drivers

- Outdoor Activities: Australia’s vast landscape and residents’ enthusiasm for camping, RV travel, and other outdoor activities have significantly increased demand for portable power solutions.

- Emergency Backup Power: In recent years, extreme weather events (such as bushfires and floods) have caused frequent power outages, making mobile power stations a reliable backup power option for households and individuals.

- Renewable Energy Trends: The integration of solar panels with mobile power stations is growing in popularity as consumers seek off-grid energy solutions.

- Technology and Policy Support

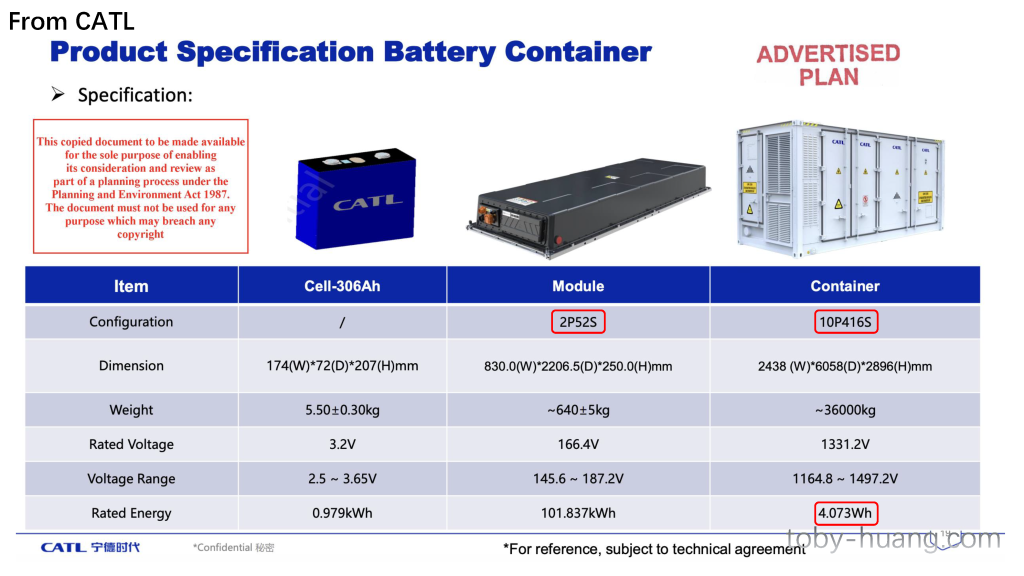

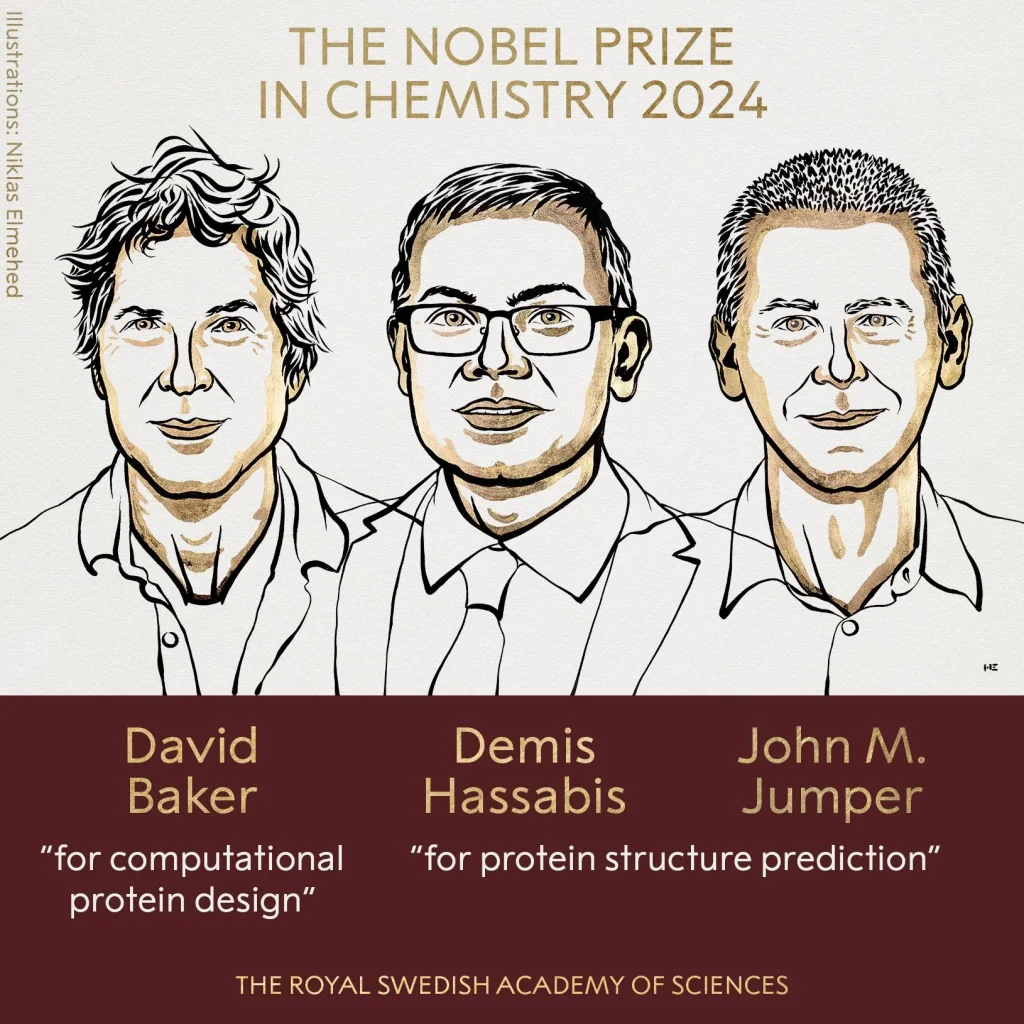

- Advances in lithium-ion battery technology have reduced production costs and enhanced product performance (e.g., higher energy density, longer lifespan).

- The Australian government’s support for green energy initiatives indirectly boosts the mobile power station market.

- Market Competition

- Key market players include EcoFlow, Bluetti, Jackery, Goal Zero, and Anker.

- Consumer priorities include capacity, portability, multifunctionality (e.g., solar charging support), and price.

Product Pricing

The pricing of lithium-ion portable power stations in the Australian market varies depending on capacity and features:

| Brand | Model | Capacity | Features | Price Range (AUD) |

|---|---|---|---|---|

| EcoFlow | Delta Pro | 3.6kWh | Expandable to 25kWh, solar/fast charging | 5,000 – 6,500 |

| Bluetti | AC200P | 2kWh | Multiple output ports, high-efficiency fast charging | 2,500 – 3,500 |

| Jackery | Explorer 1000 | 1kWh | Lightweight and portable, ideal for short outdoor use | 1,500 – 2,000 |

| Anker | PowerHouse II 800 | 0.8kWh | Compact design, suitable for personal emergencies | 1,200 – 1,500 |

| Goal Zero | Yeti 1500X | 1.5kWh | Solar charging support, ideal for long-term outdoor use | 2,800 – 3,500 |

Pricing Factors

- Capacity & Brand: Capacity is the primary determinant of price, with higher-capacity products priced higher. Brand premium also plays a significant role.

- Additional Features: Products with features like solar charging, app control, and high-power fast charging typically cost more.

- Sales Channels: Online retailers (e.g., Amazon, eBay) often offer more competitive prices, while local brick-and-mortar stores may charge slightly higher.

Transportation Costs

Domestic Transportation

- Logistics costs within Australia depend on product size, weight, and shipping distance.

Estimated Cost Range: - Small Products (1-2kWh): AUD 50-100.

- Medium Products (2-5kWh): AUD 100-200.

- Large Products (5kWh and above): AUD 200-300.

- Local logistics providers such as Australia Post or DHL offer door-to-door services, and some retailers provide free shipping.

International Transportation

- For imports from China, the U.S., or other countries, transportation costs include:

- International shipping: AUD 300-1,000 (depending on product weight and size).

- Customs duties and import taxes: Approximately 10%-15% of the product value.

- Insurance: Optional, typically 1%-2% of the product value.

- Importing products with a capacity of 1-10kWh from China tends to be more cost-effective than from the U.S. or Europe but requires additional consideration of delivery time (2-4 weeks).

Market Outlook

- Growth Potential

- The cost of lithium-ion batteries is expected to continue decreasing, lowering the price threshold for end-user products.

- Technological upgrades (e.g., adoption of solid-state batteries) will enhance product appeal in the market.

- Changing Consumer Habits

- The growing popularity of outdoor travel and the off-grid living trend has increased the demand for high-performance mobile power stations.

- Urban consumers are also increasingly seeking backup power solutions for power outages.

- Challenges

- The high prices of premium products remain a barrier for general consumers.

- The market presence of low-quality but cheaper products may erode consumer trust in mobile power stations.

Key Brand Analysis

1. EcoFlow

- Positioning: High-end market, suitable for professional users and frequent use scenarios.

- Strengths: High capacity scalability, comprehensive features, solar charging support.

- Weaknesses: Relatively expensive.

2. Bluetti

- Positioning: Balanced between multifunctionality and capacity, catering to a wide user base.

- Strengths: High cost-performance ratio, good reputation.

- Weaknesses: Slightly less portable.

3. Jackery

- Positioning: Entry-level portable power, ideal for short-term use.

- Strengths: Highly portable, simple operation.

- Weaknesses: Lower capacity.

Conclusion and Recommendations

- Market Suitability: Lithium-ion mobile power stations with a capacity of 1-10kWh are well-suited for the Australian market, particularly for outdoor activities and emergency scenarios.

- Price Range: For general users, products with a capacity of 1-2kWh are more cost-effective. High-end users prefer products with a capacity of 5kWh or more.

- Transportation Solutions: For local consumers, choosing Australian suppliers can save on transportation costs and reduce delivery times. Imported products should account for total costs, including shipping and taxes.